The rise of personalized medicine and its impact on US cold chain logistics

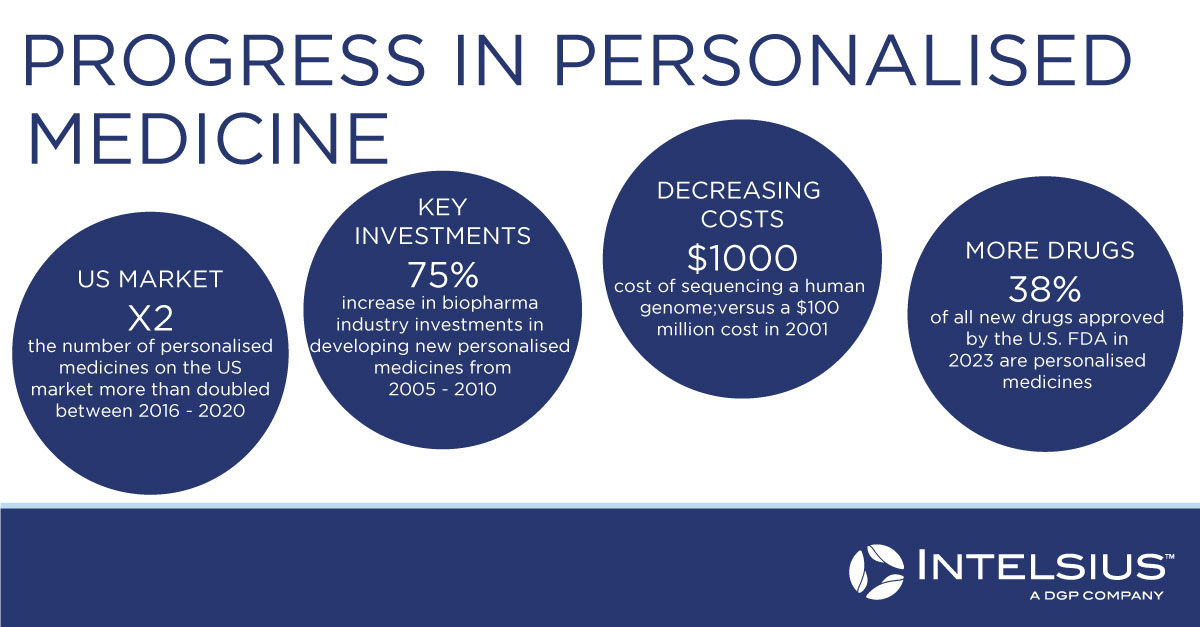

As the pharmaceutical industry adapts to the rise of new technologies and treatments, precision medicine is a developing sector that has seen the United States Food and Drug Administration (FDA) approve the first cell-based gene therapy for sickle cell disease last year. The US personalized medicine market was valued at USD168.45 billion in 2023 and is expected to reach USD 373.96 billion by 2033.

In this article, we will highlight the impacts that the rise of the industry will have on the US cold chain logistics market.

What is personalized medicine?

Personalized medicine is an approach to healthcare that considers the genes, lifestyle and environments of individuals to specially tailor disease prevention and treatment to their specific needs. The US have a highly developed pharmaceutical market, and the FDA heavily regulates the industry to ensure the safety and efficacy of drugs for public consumption. As the market moves towards tailored healthcare solutions, the safe transport of biologic and other drugs across the country becomes more crucial than ever.

How does personalized medicine work?

Personalized medicine involves carrying out diagnostic tests on a person’s genetic makeup to determine what treatments would be appropriate for their specific needs. Using these tests, physicians can specialize treatment for patients based on a combination of the individual’s genetic data, lifestyle and environmental factors. This approach can be used as a form of preventative healthcare, a form of diagnosis that can uncover the molecular underlying causes of certain diseases, as well as to provide appropriate treatment for those specific needs. In other words, diagnostic testing will reveal each individual’s genetic predisposition to certain diseases like diabetes of cardiovascular disease, so that appropriate actions can be taken, either to prevent, diagnose or treat.

Cold Chain Logistics in the US

The cold chain industry in the US can be divided into three main categories: temperature-controlled storage, like a refrigerated warehouse, cold chain logistics and transport, like a reefer truck or a cargo ship, and refrigerated packaging solutions like temperature-controlled packaging. The Covid-19 pandemic saw a shift in the way consumers purchase food items as reduced stock on grocery shelves prompted a boom in the food and beverage e-commerce industry. The cold chain growth is also driven by the pharmaceutical market’s reliance on cold chain logistics and transport for clinical trials and movement of drugs domestically and internationally. The pandemic also brought greater awareness and understanding of the importance of the cold chain, particularly during the shipment of Covid-19 vaccines which required stringent temperature-sensitive conditions during transport. The cold chain logistics market was valued at USD78.45 billion in 2024 and is expected to grow to USD110.24 billion by 2029. Labor shortages and lack of warehouse space are issues that can potentially hinder the growth of the industry; with labor costs accounting for a startling 49% of overall costs in the cold chain logistics sector.

Impact on Cold Chain Logistics

Scaling manufacturing

Due to the highly personalized and patient-specific nature of personalized medicine, the manufacturing processes for these treatments requires more specialized and complex manufacturing processes than generic drugs. Each patient’s unique genetic features are assessed and treatments are individually curated, which usually means one dedicated clean-room for one patient. Scaling this sort of manufacturing on a global level will be expensive and challenging. In other words, there will need to be paradigm shifts in the current pharmaceutical manufacturing models from large batch production to smaller productions of complex drugs. These changes would incur significant costs, taking into account that research and development costs to bring new drugs to market is currently in the range of US$1.1 billion per product. Hegemonic, a vector-based gene therapy which treats a blood disorder known as Hemophilia B, is the most expensive drug in the world, priced at a whopping US3.5 million for a single dose therapy. FDA approval for the drug was granted in November 2022. To mitigate these sky-high costs, risk-sharing agreements can be considered between governments and pharmaceutical manufacturers, where financing would be in the form of government grants in return for reduced market prices for drugs, would encourage innovation and facilitate quicker access to new drugs. Over 50% of risk-sharing agreements globally focus on the development of oncology drugs, despite the general safety and efficacy of the drugs being considered low, especially in the US.

Distribution channels

Another important consideration in the transport of personalized medicines is deciding which distribution channel to transport it through be it through hospitals, pharmacies or directly to consumers. There are associated costs with such distribution channels, particularly when each treatment is so unique to each patient. Besides route planning, getting the right volume of medication to the right patient in the right time will be another challenge. This is especially the case in patients who rely on time-sensitive treatments. For diseases like cancer, which remains one of the leading causes of death in high-income countries like the US, genetic testing and genomic technologies are crucial to develop the right treatments for sufferers. By 2018, biomarker-dependent drugs (biomarkers detect cancer-related genes) made up 42% of US Food and Drug Administration (FDA)drug approvals, doubling from 2014.

Temperature monitoring and tracking

As temperature-sensitive personalized medicines are transported internationally, they will encounter various temperature fluctuations along the way from sitting on an airplane tarmac to being moved in and out of cargo warehouses. These temperature fluctuations, while unavoidable, create a dangerous environment a payload containing stem cells or other temperature-sensitive drugs or injections. Stringent international compliance requirements would mean that cold chain packaging will play a key role in the success of personalized medicine transport. Parties along the supply chain will want to avoid temperature excursions as far as possible by either opting for passive or active temperature-controlled packaging, depending on the location and duration of the shipment journey. There will also need to be increased supply chain visibility in the form of tracking and monitoring personalized medicine shipments as it travels through different environments, terrains and climates. Being able to track temperature, humidity, shock and light is essential not only to preserve the efficacy of the treatment being transported but also to ensure a safe and efficient cold chain.

Passive or active packaging solutions?

Passive packaging solutions do not require an external power source to maintain their temperature protecting capabilities, an example would be a chilly bin or a cooler. They usually combine ice or cook packs to provide thermal protection. Active solutions on the other hand, require an external power source to maintain their temperature-protection capabilities, for example a fridge or freezer, and they actively respond to external changes in temperature.

The suitability of passive or active solutions for the transport of pharmaceutical products will depend on many factors, including:

- Shipment duration

- Size of shipment

- Cost of purchase or ownership

- Need for power supply

- Re-usability of solution.

Generally, active systems offer a high level of thermal protection but they require a lot of space and a way to power the system either using fuel, batteries or some other external power source. For these reasons, active solutions would be more suitable for large volume shipments as it would be more cost-effective and efficient, but less efficient for small volume shipments. Active systems also have a higher initial cost to operate. Meanwhile, passive systems can be scaled from small volumes to pallet-sized cargo. Passive systems are generally more flexible as they are self-contained and do not need an external power source to operate. They are relatively low in unit cost and do not require any special handling.

Given that personalized medicine shipments are generally shipped in very small quantities, passive packaging should be considered as an efficient and cost-effective solution. You can read more about the difference between active and passive packaging solutions in our article here.

Intelsius solutions

As an expert in the design and manufacture of passive packaging solutions, Intelsius has created the ORCA range - a high-performance, temperature-controlled packaging solution that is qualified for a minimum of 96 hours. We have developed these solutions and tested them to the highest international standards at our ISTA-certified laboratory in our headquarters in York, England.

The ORCA range comes in an array of sizes from the handheld ORCA Response to the fully collapsible pallet-sized ORCA, to accommodate all your payload sizes and requirements. We also offer bespoke packaging solutions that can be specifically catered to your requirements, taking into account shipping routes, level of thermal protection needed and shipment duration.

Get in touch

If you would like to know more about the ORCA range or our other temperature-controlled packaging solutions, or if you would like to find out more about our bespoke packaging solutions, contact cs@intelsius.com and our customer service representatives would be happy to help you with your queries.

Dry Ice Shippers

Dry Ice Shippers

Pallet Shippers

Pallet Shippers

Rental Service

Rental Service

ORCA Solutions

ORCA Solutions

Data Loggers

Data Loggers

Brown Outer Shipper Boxes

Brown Outer Shipper Boxes

Personal Medicine Carriers

Personal Medicine Carriers

Category A Packaging

Category A Packaging

Pathoshields

Pathoshields

PathoPouch and PathoSeal

PathoPouch and PathoSeal

Biotherm Extreme

Biotherm Extreme

Biomailer

Biomailer

Miscellaneous Components

Miscellaneous Components

COVID-19 Sample Transport Packaging

COVID-19 Sample Transport Packaging

Compliance Labelling

Compliance Labelling

Cold Chain Guide

Cold Chain Guide

UN3373 Sample Guide

UN3373 Sample Guide

About Us

About Us

Markets we Serve

Markets we Serve

Services

Services

Freight Charges

Freight Charges